Taxation and the digitalized economy

States around the world are working out whether and how they ought to increase the taxation of major multinationals, particularly those in the high tech/digital sectors. The stakes have only increased as the pandemic has accelerated the pace of digitalization and created massive economic windfalls for some while being the source of major upheaval and destruction for the masses. Yet the reforms under consideration in both national and international spheres go to the very heart of the design of tax systems: they ask who may tax whom, on what basis, when, how much, and how to implement the ideas. My research examines these fundamentals and asks whether we are building sustainable tax designs for an uncertain future, or simply continuing on the pathways forged a century ago.

On this page you will find my working papers, talks, blog posts, infographics, and other resources I’ve gathered and produced as I develop this line of research.

US Treasury Sec. Mnuchin wrote a letter to four finance ministers to complain about unilateral digital services taxes but also to insist that everyone stop trying to reach consensus on taxing the digital economy…

Tomorrow at 9AM EST, 2PM BST, I’ll present my analysis of the OECD’s digital tax consensus impact assessment…

Preliminary Analysis of OECD Pillar 1 Impact Assessment + KPMG Transfer Pricing Study of Amounts B & C

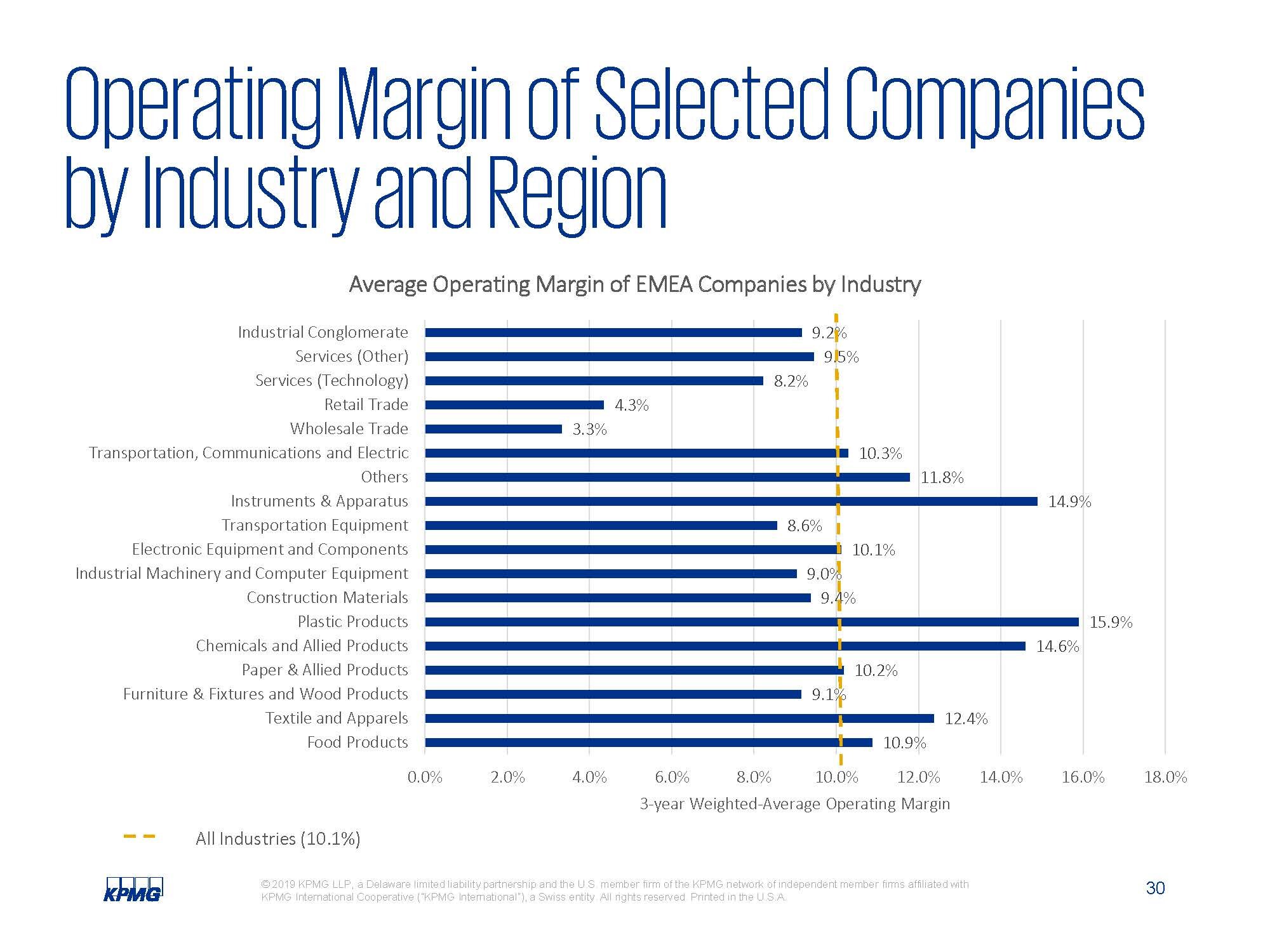

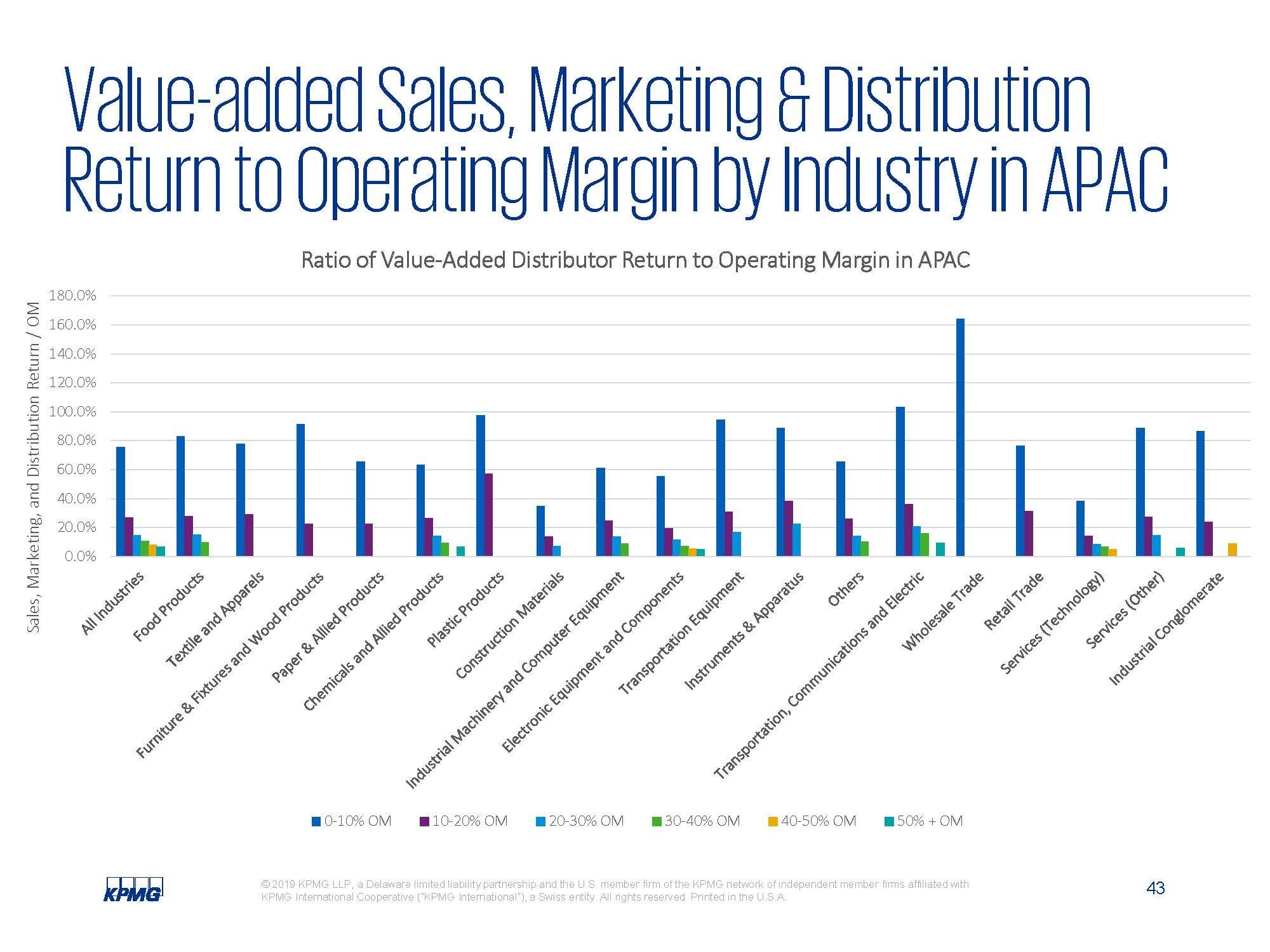

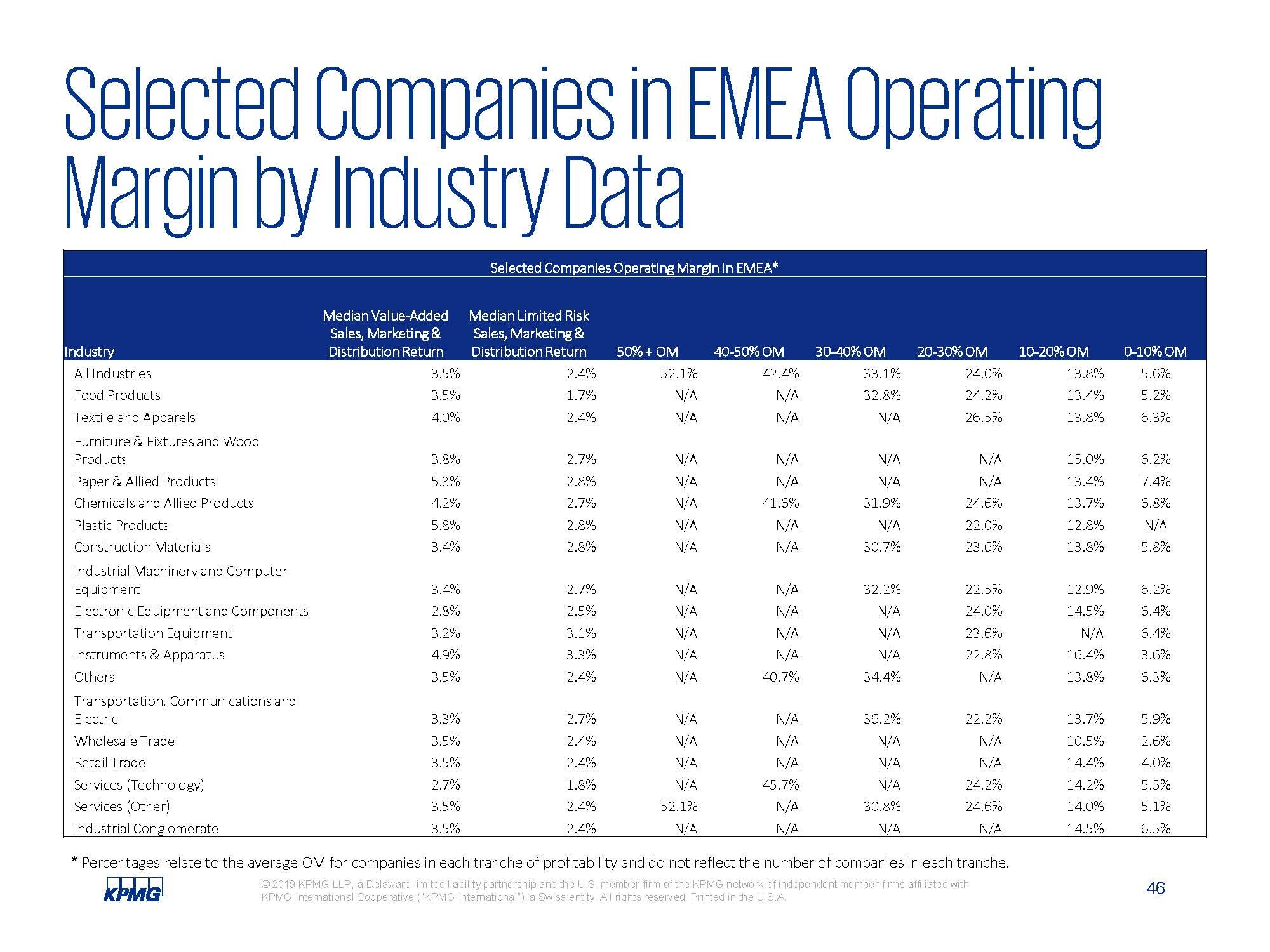

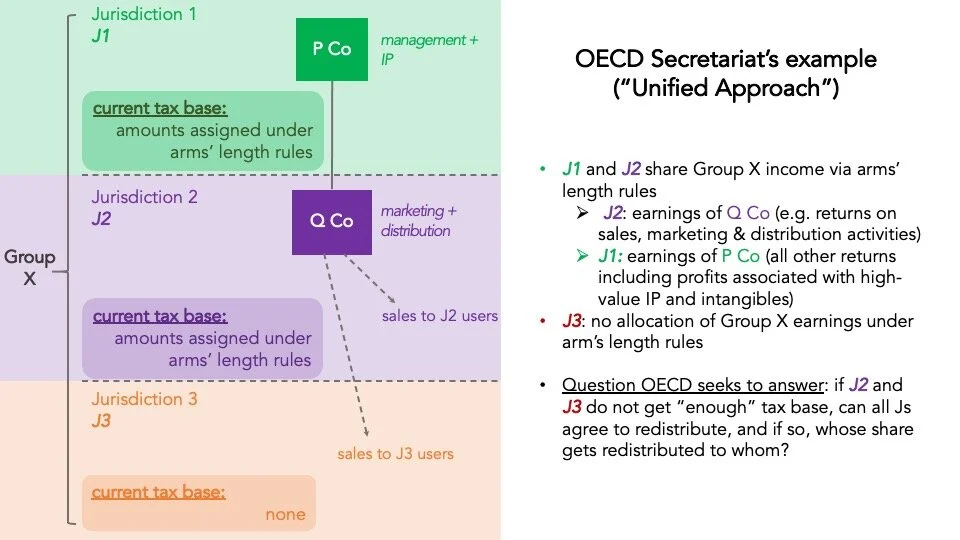

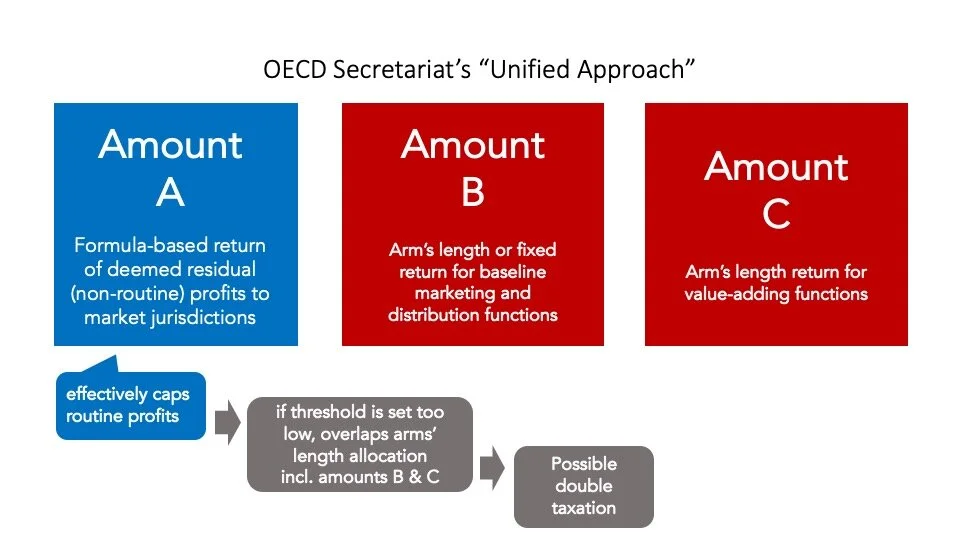

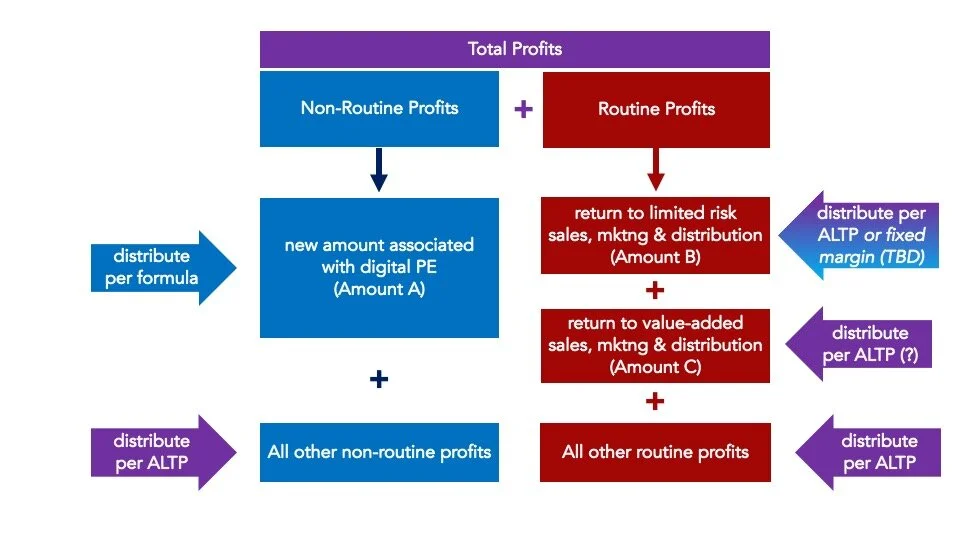

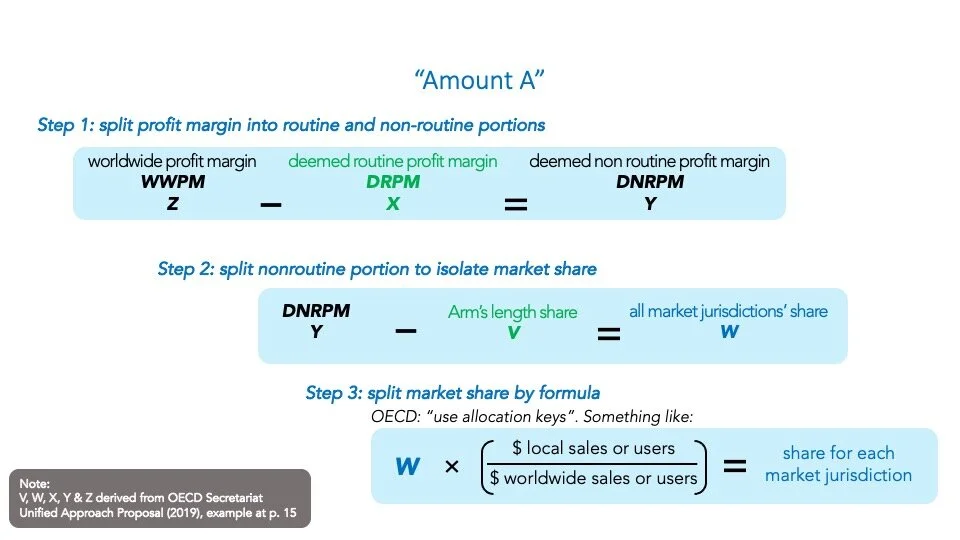

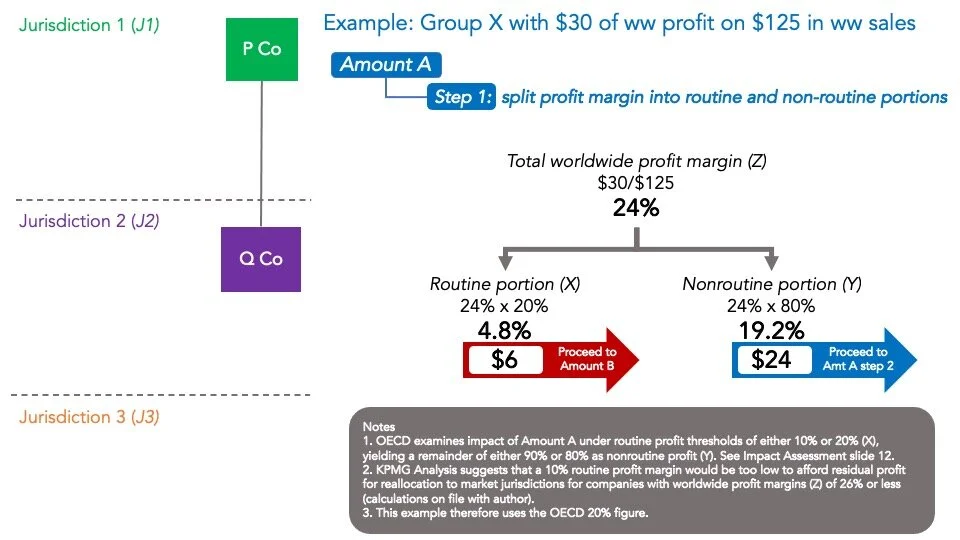

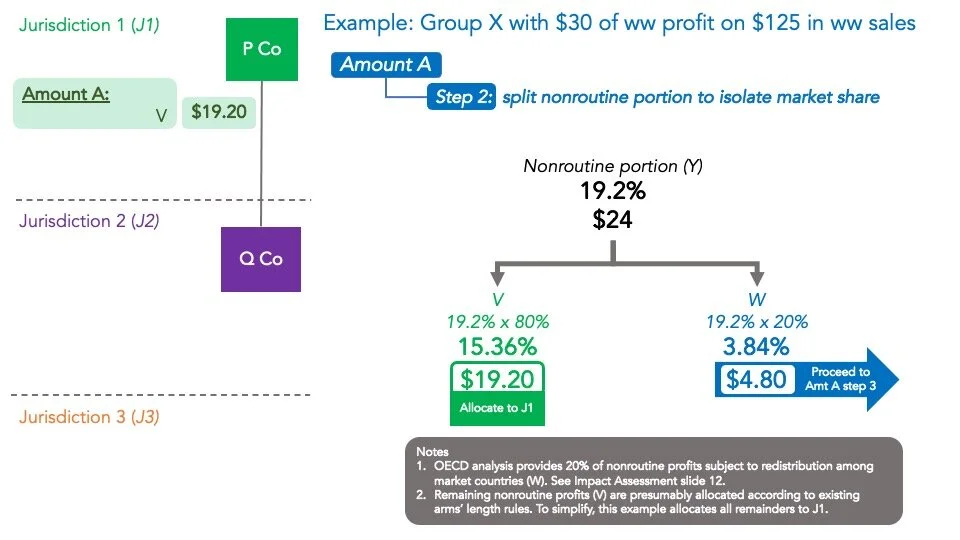

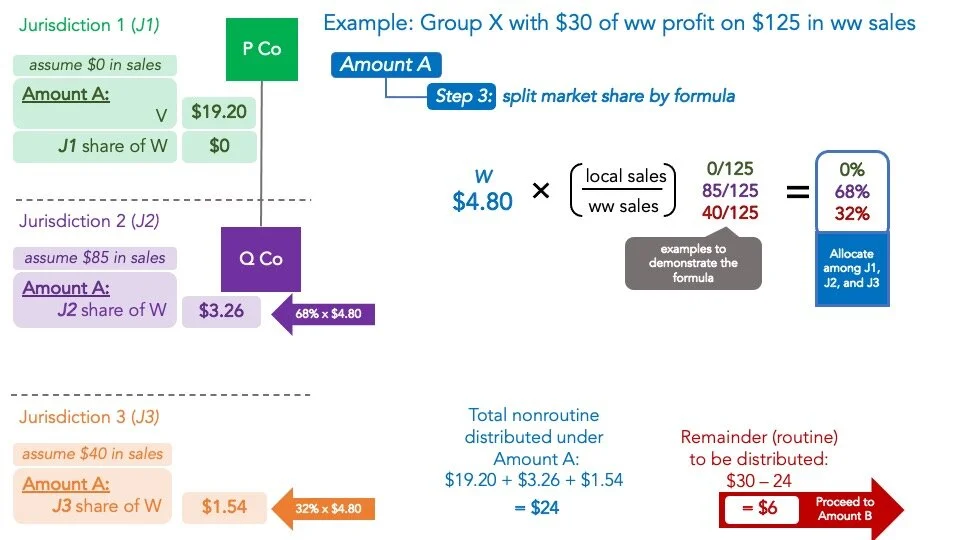

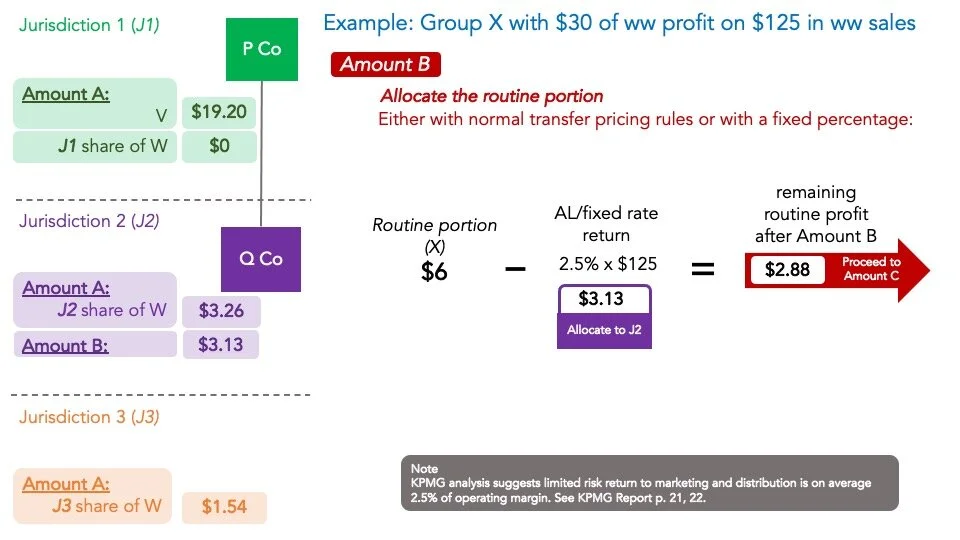

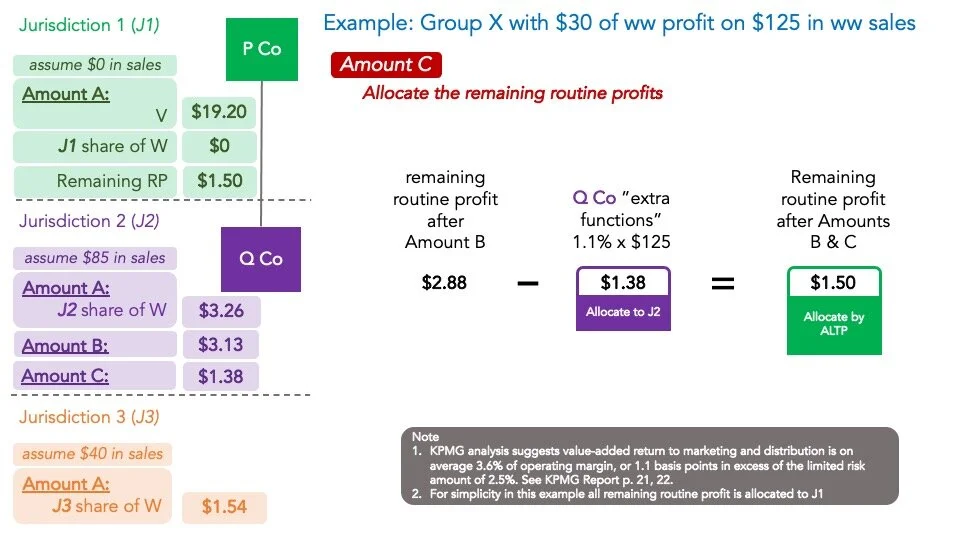

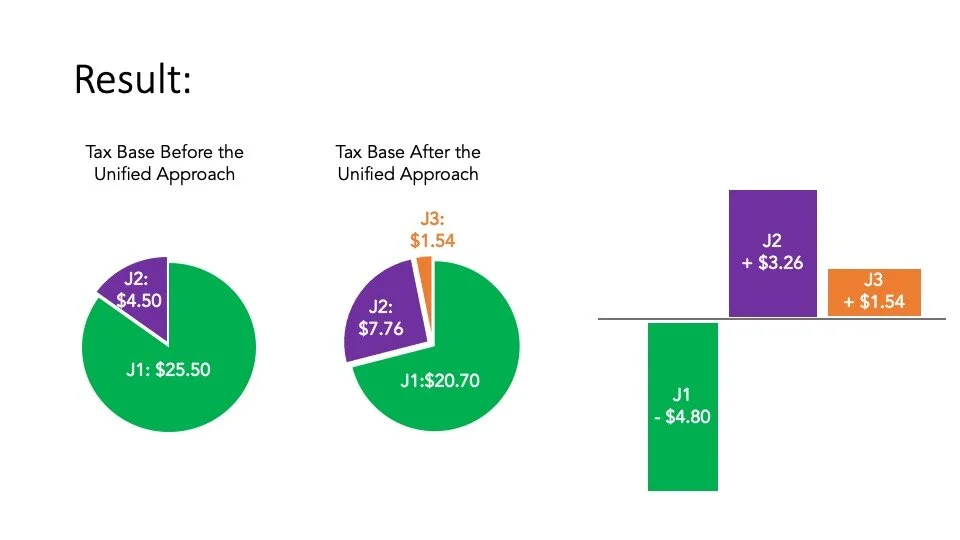

A recent KPMG transfer pricing study posits fixed percentages for returns to marketing and distribution activities, a.k.a. Amounts B and C in OECD parlance. The study casts some light on the OECD's design for a new global tax allocation respecting the profits of certain digital economy firms. By extrapolating from Amounts B and C, the KPMG study helps draw a very rough estimate of what Amount A potentially looks like (granularity is impossible because, among other things, how much routine and non routine profit is attributable to factors other than Amounts A, B, and C cannot be determined in the abstract).

In this excel spreadsheet, I've developed a formula from the OECD Secretariat's Unified Approach, applying the fixed routine (10% and 20%) and market share (20%) numbers the OECD used by way of example in its Impact Analysis, and plugging in the KPMG percentages for Amounts B and C. I walk through the analysis in this powerpoint.

The KPMG Study provides a starting point to consider how firms are likely to approach Pillar One and how nations are likely to fare under the OECD Secretariat's approach, now endorsed by the Inclusive Framework. Briefly, the study is described as "a fact-based economic analysis using comparables data of the arm’s length returns to sales, marketing and distribution," prepared by KPMG under commission by Microsoft. It looks more like a standard transfer pricing report than an actual economic analysis, and it raises the usual pile of questions about assumptions and definitions but it is a starting point for understanding the scope of possible redistribution under Pillar One. Like the Study and the OECD Impact Analysis, I've made a bunch of simplifying assumptions and would benefit from comments and suggestions.