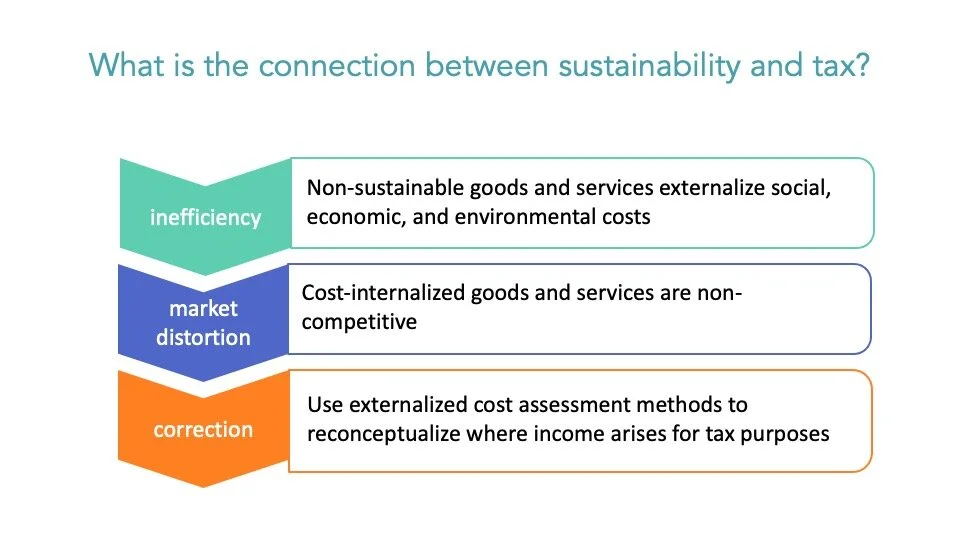

What makes a tax system sustainable?

A sustainable the tax system would reflect the real value of human and natural resources while respecting the principle that anyone affected by a tax system ought to have a say in its design.

∞

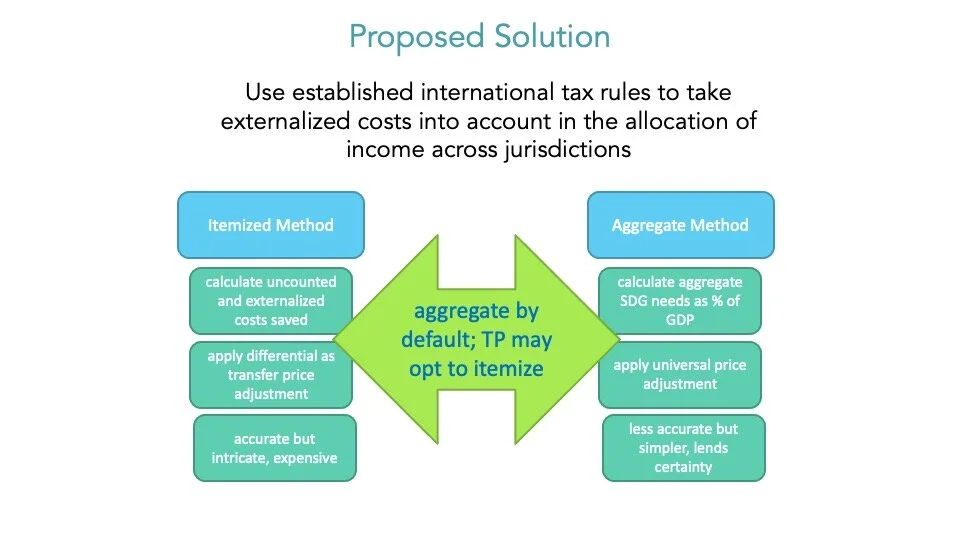

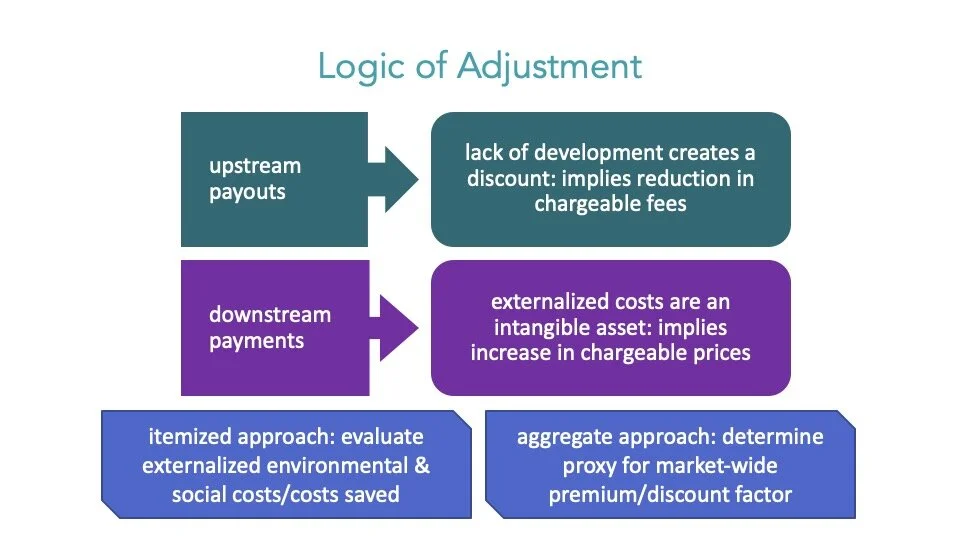

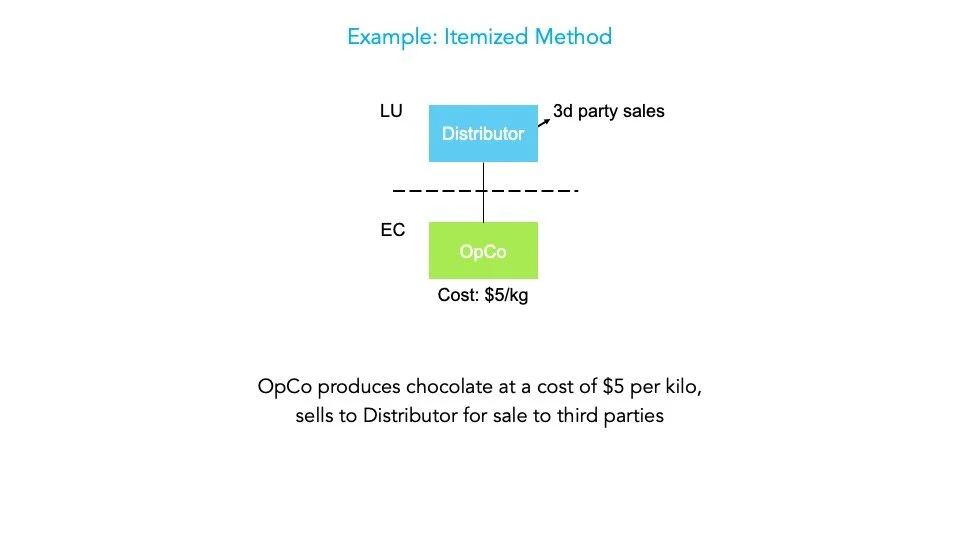

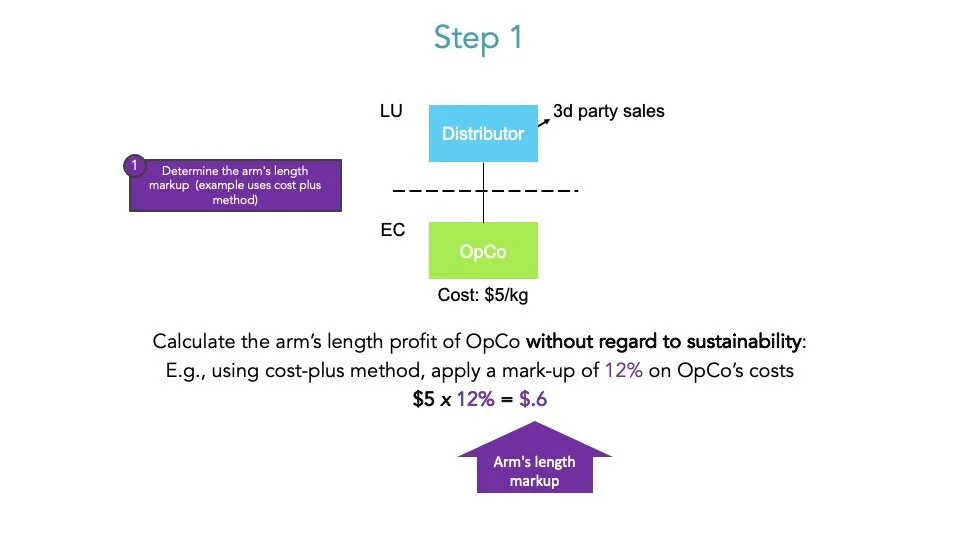

The sustainable tax project aims to demonstrate how and why externalities associated with unsustainable practices can be reflected in today’s global tax rules, and why doing so would better ensure that all those affected by global tax rules are properly represented.

∞

We are using data associated with the sustainable development goals (Agenda 2030) and emerging externality measuring tools to more accurately measure the economic value of uncompensated costs to societies and the environment. Because we believe that some consumers and investors want to make more sustainable choices, the research is not focused solely on regulatory reform but also connects with corporate social responsibility and ESG/sustainable investing frameworks.

Videos

Remarks at the inaugural conference of the Platform for Collaboration on Tax, held at the UN in February, 2018.

Interview with Convention of Independent Financial Advisors (CIFA) at Sustainable Investing Event, United Nations, 2019

Project overview

Working Papers and Publications

Funding Pandemic Prevention: Proposal for a Meat and Wild Animal Tax

Allison Christians, Morgane Larnder-Besner & Julien Tremblay-Gravel.

Sustainability, v. 12(21) (2020)

Market prices fail to properly account for the risk of zoonotic diseases associated with animal agriculture and cross-border trade in domesticated and wild animal products, the magnitude of which is demonstrated by the COVID-19 pandemic. Corrective measures are required to internalize the cost of pandemics. Communicable disease prevention and mitigation is a global public good and contributions to its production should be made at the international level. To compel states to pay for costs resulting from domestic consumption patterns that are externalized to other countries, this paper proposes a global contribution regime based on state consumption of animal products. We lay out the technical aspects of a cost-internalizing tax that could accomplish this goal and demonstrate its feasibility in light of existing trade law constraints. The paper concludes that the proposed cost-internalizing tax would be an appropriate method to deter pandemic risk-inducing activities and fund zoonotic disease outbreak prevention and pandemic response.

Read the paper here (open access)

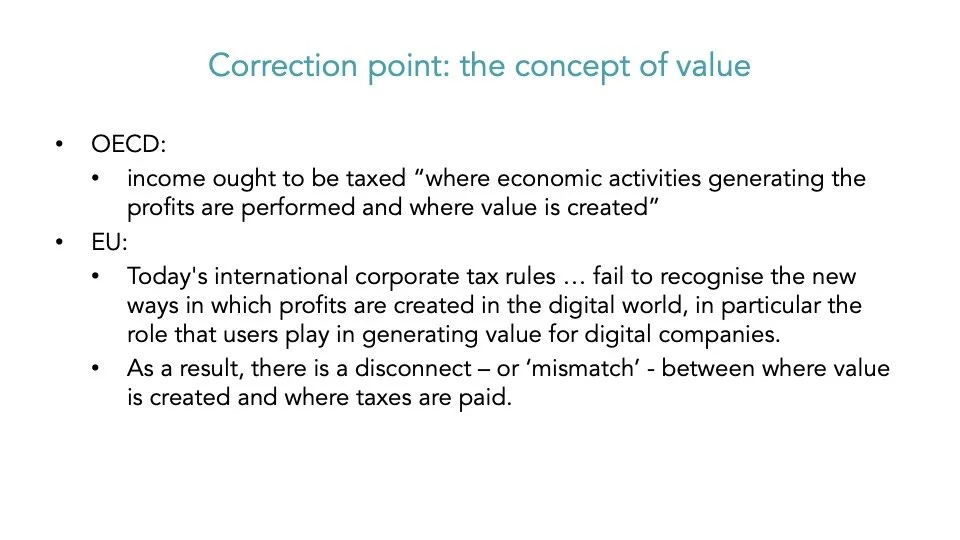

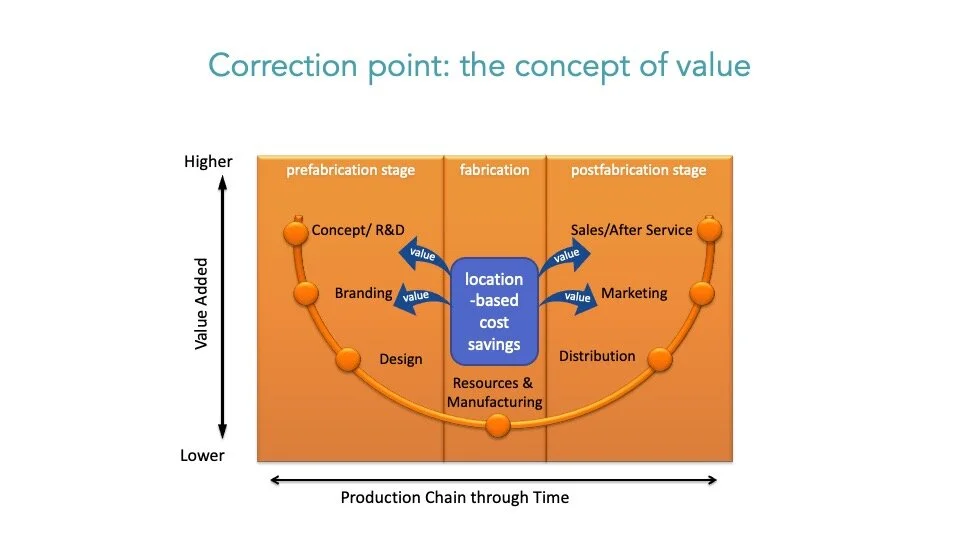

Taxing Income Where Value is Created

Allison Christians & Laurens van Apeldoorn

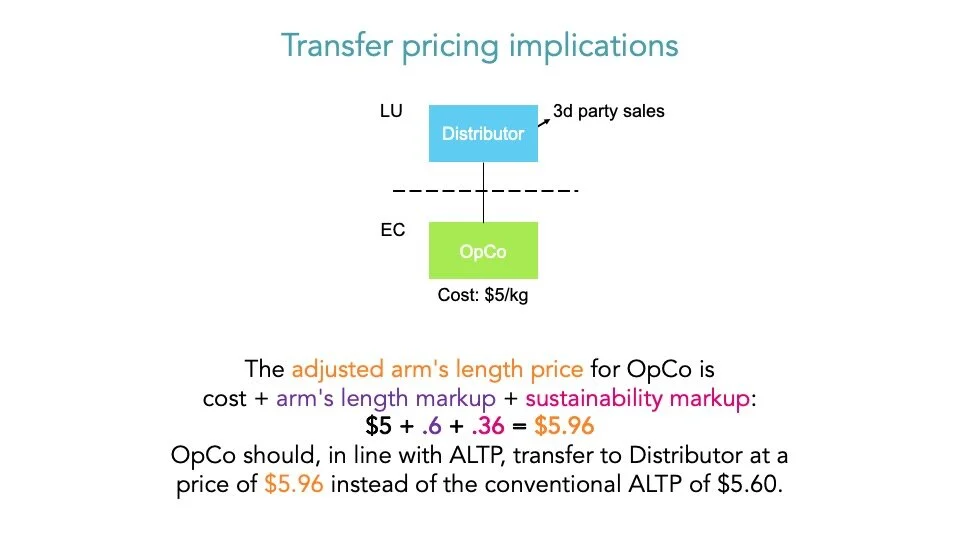

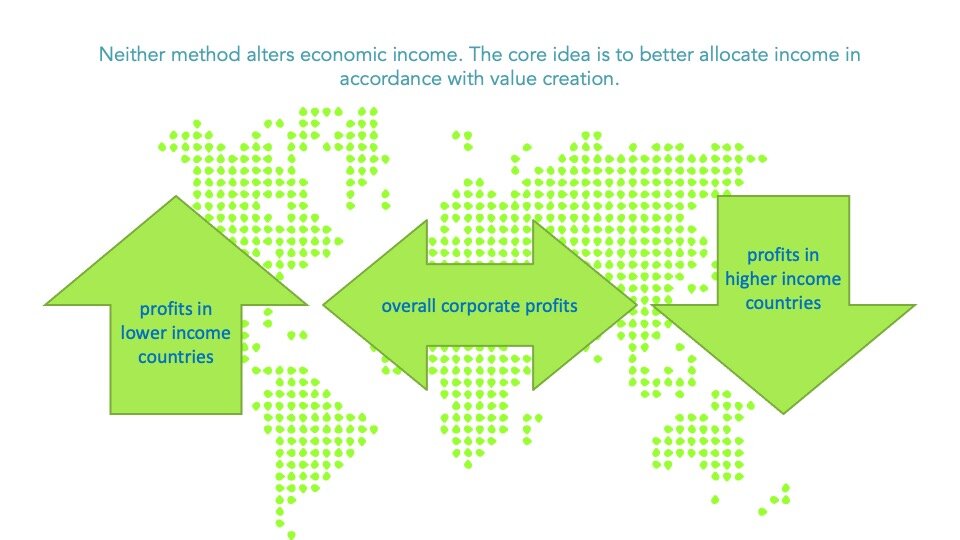

It is said that income should be taxed where value is created, but contemporary global tax rules rely on assumptions about value that tend to favour rich countries while, whether intentionally or not, depriving poorer countries of their proper share. This Article argues that a rigorous examination of what we mean by value could prompt needed reform. We examine wages paid to workers in low-income countries and reveal a clear and well-documented gap between market price and fair market value resulting from labour exploitation. We demonstrate how to apply this knowledge to reallocate global profits in line with the value-based ideal.

Read the paper here (open access)

A Sceptic’s Guide to Justice in International Tax Policy

Laurens van Apeldoorn

What, if any, are the moral norms governing the international taxation regime if the sceptic is right to think that considerations of distributive justice do not apply beyond the state? I sketch an answer to this question by examining Tsilly Dagan’s illuminating recent book International Tax Policy: Between Competition and Cooperation. I establish that Dagan’s argument that Nagel is committed to a duty of justice to promote distributive justice abroad faces some significant obstacles and suggest that Dagan can ground her argument in a humanitarian duty that Nagel does accept. The upshot of the argument is that even if the sceptic is right to think that considerations of distributive justice do not apply beyond the state, multilateral tax cooperation is governed by a duty of states to prevent human rights deficits where they can.

Read the paper here (open access)

A New Global Tax Deal for the Digital Age

Allison Christians and Tarcisio Diniz Magalhaes

The Organisation for Economic Co-operation and Development (OECD) is in the midst of a project intended to tackle the tax challenges arising from the digitalization of the economy. As initially laid out in its program of work released in May 2019, the goal is to develop consensus on a new taxing right that would allow countries to tax multinationals even in the absence of traditional physical presence. In this paper, the authors argue that upon inspection, the plan seems primarily focused on rebalancing taxing rights mostly among a number of OECD member states plus a few other key non-OECD states, and that, viewed from this perspective, the urgent effort to forge a new global tax deal for the digital age risks deferring a much-needed discussion on the broader distributive implications of the current global tax deal to some unspecified future time. The first part of the paper offers a brief survey of some of the main factors that prompted the OECD to turn its attention to this topic. The second part considers the origins and development of nexus in the international tax regime, showing why this concept is amenable to broad expansion. The third part examines the range of reforms currently under consideration, arguing that the framing on digitalization misses a necessary connection to other pressing international policy programs that are also under development, most notably a global commitment to building institutions that support sustainable economic development. The paper concludes with a prediction that on its current trajectory, the program of work on digitalization is likely to produce a new global tax deal that looks much like the old global tax deal, with a relatively modest redistribution of taxing rights among a few key states, thus missing an opportunity for meaningful reform.

Read the paper here (open access)

Exploitation, international taxation, and global justice

Laurens van Apeldoorn

The OECD’s tax base erosion and profit shifting initiative claims that (corporate) profits should be taxed where economic activities are performed and where value is created. I argue that this idea depends on establishing that states are entitled to the productive factors in their territory. This cannot presently be established. If states fail to discharge duties requiring wealth redistribution, they do not have an unqualified right to the productive factors in their territory. Even if they are not subject to such duties, states can only legitimately claim a share in the fair value of the goods created. I show that given widespread exploitation in global value chains, the market prices of (intermediary) goods do not reflect their fair value.

Read the paper here (open access)

Designing a General Anti-Avoidance Rule for the East African Community – A Comparative Analysis

Afton Titus

The East African Community (EAC) is a regional integration project working towards the formation of a political federation. As a grouping of developing states, most EAC Partner States have legislated their own general anti-avoidance rules (GAARs) as a means to prevent base erosion and profit shifting. This article argues that the EAC federation, once formed, should continue this practice and legislate its own GAAR to protect its corporate tax base – one of the most important tax bases for Africancountries. This article further proposes a GAAR for the EAC that builds on the existing GAARs in the EAC Partner States and draws from international best practice through a comparative analysis of the GAARs in the EU Anti-Tax Avoidance Directive, the Income Tax Act in Canada and the Income Tax Act in South Africa. In so doing, the author proposes a GAAR for the EAC that is in keeping with international developments while adapting such developments to the EAC context.

Read the paper here (gated)

What Is Really Wrong with Global Tax Governance and How to Properly Fix It

Tarcisio Diniz Magalhaes

During the course of the last 100 years, the wealthiest and most powerful nations on the planet have systematically gathered around in small groups of experts, scientific committees and working parties, under the auspices of the League of Nations and the OECD, to decide on the appropriate tax policy norms for global implementation. The immediate consequence was, and still is, the creation of an exclusionary architecture that deprives the majority of the world’s countries from meaningfully influencing legal-institutional choices vis-à-vis what countries should tax cross-border transactions, a process that has clear global distributional implications. Rejecting old and new solutions for a just world tax order, the author believes a completely different approach is needed, grounded on contested multilateral practices and diversity of world views. Using critical legal theory, the goal is to provide an alternative way to think (politically) about fiscal relations among developed and developing states.

Read the paper here (open access)

A Few Words on Designing Sustainable Tax Systems

Lily Maya Wang

On November 25, Prof. Christians hosted an interdisciplinary workshop entitled Designing Sustainable Tax Systems as part of the tax policy colloquium. The workshop brought together scholars and students to discuss what sustainability means and implies for taxation. As a student in both Tax Policy and International Taxation courses this semester, I found the workshop to be a truly eye-opening experience and decided to interview two of the speakers, Julien Tremblay-Gravel and Dr. Magalhaes, to share their thoughts on this event.